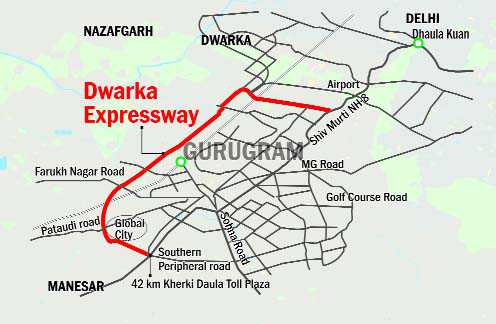

OCUS Medley - Dwarka Expressway, Gurgaon

OCUS Medley – Test

M3M 113 Market, Dwarka Expressway, Gurgaon

M3M 113 MARKET- TEST

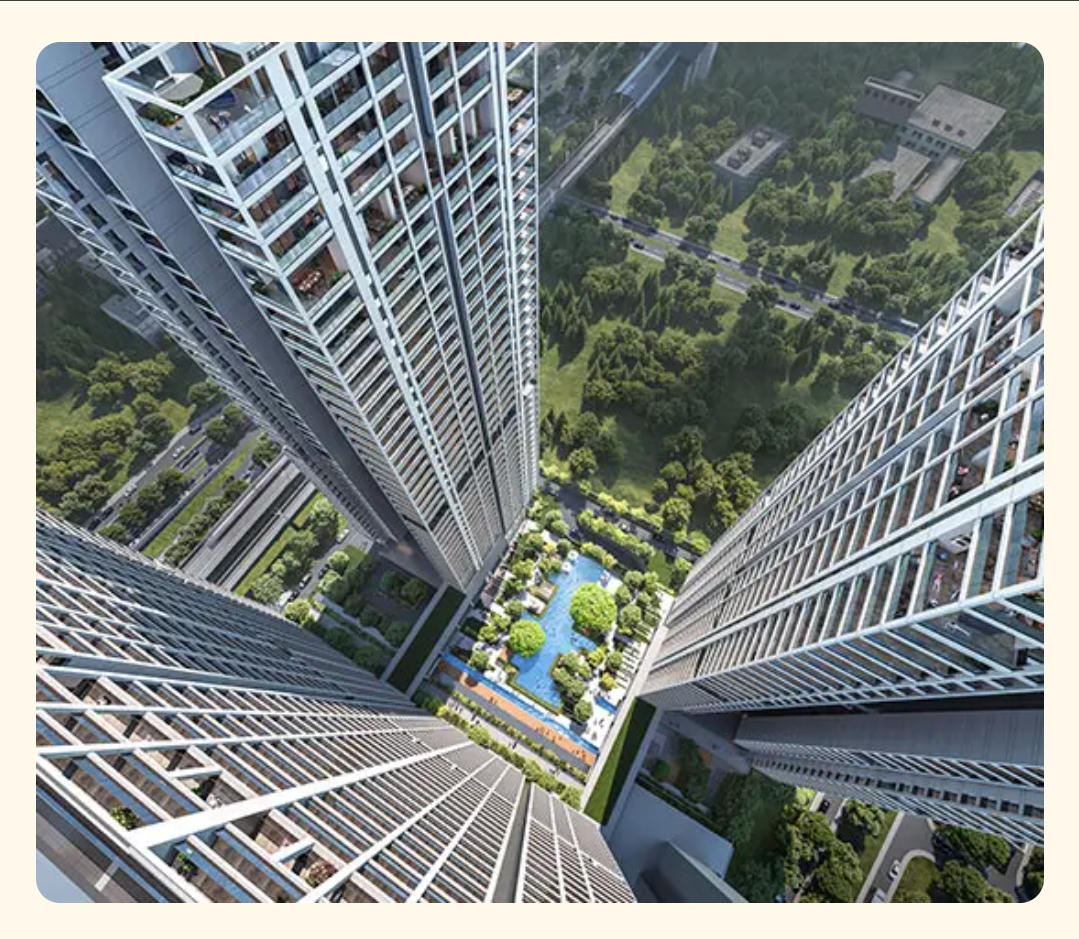

SOBHA ARANYA, SEC-80, GURUGRAM

SOBHA ARANYA , SEC 80, Gurgaon Two visionaries SOBHA...

- 3 beds

- 3 baths

THE LEELA SKY VILLA, DELHI

THE LEELA SKY VILLA, KIRTI NAGAR, DELHI The highest...

- 3 beds

- 3 baths

DeLUXE DXP, SEC 37D, DEW, GURUGRAM

DE LUXE DXP , SEC 37D, Gurgaon 3.5 &...

- 3 beds

- 3 baths

M3M MANSIONS , SEC 113, DEW, GURUGRAM

M3M MANSION , Sector 113, Gurgaon M3M Mansion Sector 113...

- 3 beds

- 3 baths

DLF ONE MIDTOWN, SHIVAJI MARG, DELHI

DLF One Midtown- The New Heart Of Delhi Explore...

- 3 beds

- 3 baths

MINERVA By SP, MUMBAI

India’s tallest residential tower Standing tall at an impressive 300...

- 3 beds

- 2 baths

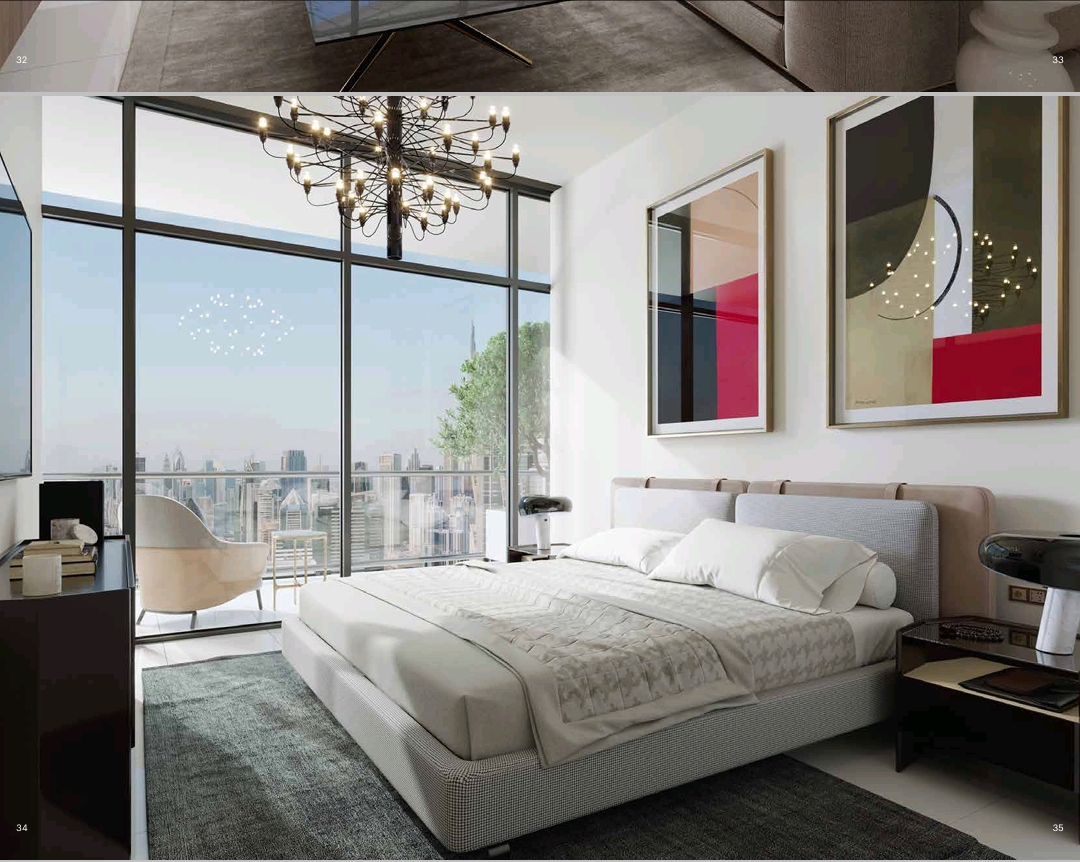

AL HABTOOR TOWER, SKY VILLA, DUBAI

Beautifully Designed Spaces Where Living Meets Luxury Immerse yourself in...

- 2 beds

- 2 baths

TARC KAILASA, KIRTI NAGAR, DELHI

TARC KAILASA- Connected To The Past, Present And Future Of...

- 3 beds

- 3 baths

- 6.5 acres

THE SAPPHIRE BY DAMAC, BAY AREA, DUBAI

Urban living comes alive at The Sapphire, a collection of...

- 4 beds

- 4 baths

- 4400 acres

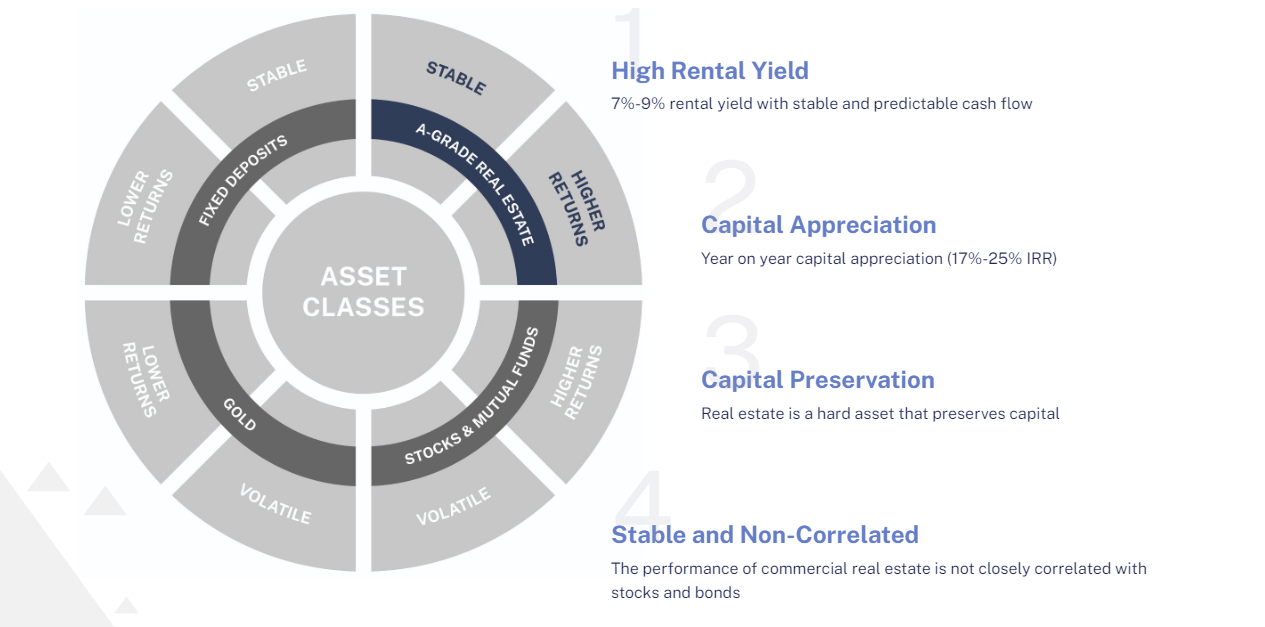

Let's Compare Between Investments of

Commercial Real Estate & Residential Real Estates

Commercial Real Estate (CRE)

Luxury Residential RE (LRRE)

Residential Real Estate (RRE)

RENTAL AVERAGE-

7%-9% (per annum)

(i.e 1 Cr Investment- Rental 8.7 Lac)

4%-6% (Per Annum)

2%-3% (per annum)

(i.e 2 Cr Investment -Rental 4.2 Lac)

PRINCIPAL APPRECIATION-

4%-10% (per annum)

4%-8% (per annum)

3%-5% (per annum)

RETURN(IRR)-

(IRR) is a metric used to analyze capital budgeting projects and evaluate real estate over time.

11%-19%

10%-18%

5%-8%

STABILITY FACTOR-

Long Lease Signed (9-15 Years) With Company/ MNC Tenants

Long Lease Signed (3-5 Years) With HNI/ MNC Tenants

Unstable Tenancy Due To Short Lease Tenures With Individuals As Tenants

“Real estate is the world’s biggest asset class, with a projected value of $613.60 trillion in 2023. However, this market is also known for being notoriously behind in digitalization, On HIGHER RETURN side, although there are significant differences between these two asset classes i.e Real Estate & Stock -Mutual Fund, it’s important to keep in mind that real estate can be a good alternative to stocks due to its lower risk, higher returns, and fair level of diversification.”

ONE COMMUNITY, ONE PROJECT & ONE FAMILY

INVESTO, India’s First D2C Real Estate Investment Partners Community, investing in Lucrative asset class like Real estate.

We approach top real estate brands for their premium inventories, in both luxury residential & commercial real estate, after internal approval & risk studies , we present & convince our community, to join in the investment journey.

Our active management investment strategy is designed to deliver a well-balanced and of globally diversified standard that will maximize sustained long-term returns without incurring undue risk. Our performance is driven by a long horizon and global scale so we can pursue investment strategies others cannot. Our unique mandate, talented global team, distinctive culture, and strong brand approach further sets us apart.

With this approach we’re able to achieve an effective balance of risks and returns while seeking to add significant value through active management engagement. Our goal is to achieve sustainable returns over the long term in the best interests of our contributors and beneficiaries.

Our absolute performance reporting shows the returns of Investment, earned over one, five and 10-year time horizons. Our relative performance evaluates the Fund’s returns in the context of our benchmarks.

We generally do not respond to unsolicited investment proposals. To build a diversified portfolio, with minimum investment of 5 Cr+ required.

As an investor Management community, we keep all your priorities on Top agenda. We don’t charge Brokerage. Always offer undisputed properties, with all due diligence. Also Resale your property with excellent value appreciation.

We manage all burden of property management, including maintenance, tenant relations, ligalities and repairs.

We have many promotional offers, from time to time, you can connect to our helpline, to get information.

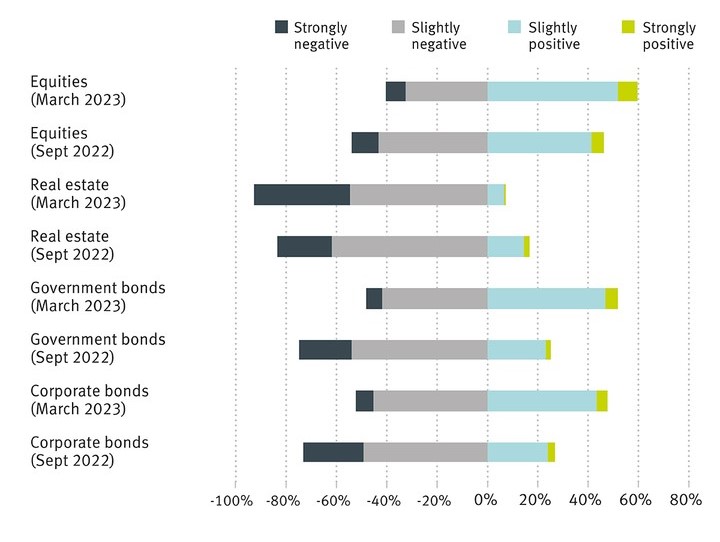

REAL ESTATE INVESTMENT RISK ASSESMENT INDICATOR!

REAL ESTATE*

UBER LUXURY COMMUNITY EXPERIENCE

INVESTO Millionaires community , is my favorite, they are very hard working partners, always take care of investments, they will not neglect your purpose & Vision. Am associated with them since 2011.

In 2020, I was looking for someone, who can sale my Land Parcel in Himachal Pradesh & short list new asset in Delhi for Exchange, INVESTO made it without charging me a single penny, they are professional , Trusted guys.

I have invested in 7 Property Locations in Delhi NCR, everything under one roof, Buy, Watch & Exit with guaranteed appreciation. I knew various member in their community, from South Delhi, you can trust them, while dealing in Luxury Home, firm House, Plots or any Commercial Investments.

SUPERBRAND ASSETS IN OUR PROPERTY BANK

---:Giving Back To Society:---

![[INVESTO: INDIA'S FIRST D2C REAL ESTATE INVESTMENT PARTNERS]](https://first.investo.homes/wp-content/uploads/2024/02/IMG_20240223_162449.png)